Public debt in developing countries rising rapidly – UNCTAD

Folarin Abiodun

The UN Development and Trade (UNCTAD) has said that public debt in developing countries has grown twice as fast as in developed economies since 2010.

According to the UN agency, the $31 trillion debt by developing economies in 2024 is less than the overall global debt of $102 trillion.

A World of Debt Report 2025 notes a stark contrast among developing regions. Asia and Oceania hold 24% of global public debt, followed by Latin America and the Caribbean (5%), and Africa (2%). “The burden of this debt varies significantly based on the price and maturity of the debt finance countries have access to, and is further exacerbated by the inequality embedded in the international financial architecture,” it stated.

UNCTAD stated that developing countries are now facing a high and growing cost of external public debt as debt service on external public debt reached $487 billion in 2023. Half of developing countries were paying at least 6.5% of export revenues to service external public debt.

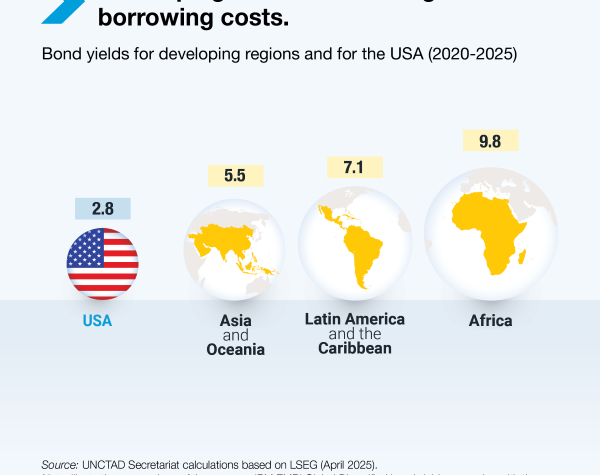

“This dynamic is largely a result of high borrowing costs, which increase the resources needed to pay creditors, making it difficult for developing countries to finance investments. Since 2020, developing regions have been borrowing at rates that are two to four times higher than those for the United States.

“Moreover, developing countries experienced a net resource outflow for the second year in a row. In 2023, they paid $25 billion more to their external creditors in debt servicing than they received in fresh disbursements, resulting in a negative net resource transfer.

“The impact of these trends on development is a major concern, as people pay the price. Persistently high interest rates, weak global economic prospects and heightened uncertainty are having a direct impact on public budgets. Developing countries’ net interest payments on public debt reached $921 billion in 2024, a 10% increase compared to 2023. In the same vein, a record 61 developing countries allocated 10% or more of government revenues to interest payments.

“Developing countries’ interest payments are not only growing rapidly but also outpacing growth in critical public expenditures, such as on health and education.

“As a consequence, in many developing countries, the need to service existing obligations is constraining spending in other key areas essential for sustainable development. Overall, a total of 3.4 billion people live in countries that spend more on interest payments than on either health or education,” UNCTAD explained in the report.

The report pointed out that developing countries must not be forced to choose between their debt servicing obligations or servicing their people.

Thus, there is now a pressing need to reform the international finance architecture. Part of the recommendations from the report include: Making the system more inclusive and development-oriented; enhancing the availability of liquidity in times of crisis; creating an effective debt workout mechanism that addresses current deficiencies; and providing more and better concession finance and technical assistance to support countries in tackling the high cost of debt.