NDIC, NIESV Deepen Ties on Failed Bank Asset Valuation

Barbara Bako, Abuja.

The Nigeria Deposit Insurance Corporation (NDIC) has called for deeper collaboration with the Nigerian Institution of Estate Surveyors and Valuers (NIESV) to ensure accurate valuation of assets belonging to failed banks, describing it as vital to effective liquidation and depositors’ repayment.

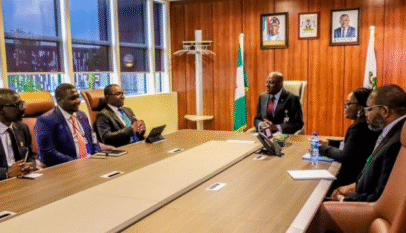

NDIC Managing Director/Chief Executive, Mr. Thompson Oludare Sunday, made the appeal when the President and Chairman of Council of NIESV, Dr. Victor Adekunle Alonge, led a delegation on a courtesy visit to the Corporation’s headquarters in Abuja.

Sunday said the NDIC depends on credible valuation reports from certified professionals to determine the true worth of assets of failed financial institutions, which in turn enables their sale at optimal value.

According to him, proceeds from such sales are key to paying depositors whose balances exceed the insured limit.

He stressed that professionalism, accuracy and transparency in valuation directly support financial system stability.

He also urged NIESV to uphold high ethical standards and guard against insider abuse, while disclosing that the Corporation is developing a comprehensive Asset Management Policy to strengthen asset identification, documentation, valuation and disposal processes.

The NDIC boss expressed interest in joint training and knowledge-sharing initiatives between the two institutions, particularly in modern valuation techniques, sustainable practices and asset management.

In his remarks, NIESV President, Dr. Alonge, reaffirmed the Institution’s commitment to integrity and professionalism.

He noted that NIESV, established by an Act of Parliament, maintains strict disciplinary procedures to sanction unethical conduct among members.

He pledged continued cooperation and technical support to the NDIC, adding that the partnership is crucial to improving service delivery and public confidence in the banking sector.

The visit highlighted the shared commitment of both bodies to stronger collaboration, improved professional standards and a more robust framework for bank liquidation in Nigeria.