302nd MPC: CBN in race to curb biting effects of FG’s economic reforms policy

Abiodun Folarin

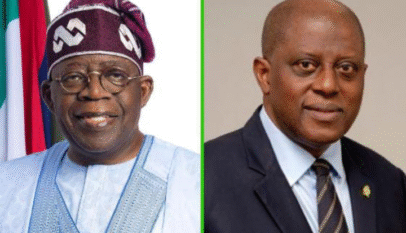

As the various economic reforms policy of President Bola Tinubu is taking its toll on the financial wellbeing of most Nigerians, the Central Bank of Nigeria (CBN) too is not only showing that it’s aware of the concomitant pains that must come with the policy, but is also advancing on possible economic measures that ensure the pains is short-lived.

It’s in pursuance of bringing timely relief to Nigerians that the apex bank held a Monetary Policy Committee (MPC) meeting, the 302nd of its kind, between September 23-25, 2025 to review key developments in the global and domestic economies in guiding its course of action in the relief efforts and to pace up with best global practices doing so.

The Monetary Policy Committee (MPC) is the Central Bank of Nigeria’s highest decision-making body, responsible for shaping the nation’s monetary and credit policies to ensure price stability and support economic growth. Its significance lies in its role in analyzing economic conditions, setting the crucial Monetary Policy Rate (MPR) and other policy instruments, and communicating decisions to the public, thereby influencing inflation, exchange rates, interest rates, and overall financial stability in Nigeria.

At the 302nd post-MPC briefing in Abuja, CBN Governor Olayemi Cardoso announced the Bank’s first rate cut in five years, lowering MPR to 27% after five months of sustained disinflation.

The MPC also raised Cash Reserve Ratio (CRR) for commercial banks to 45% and introduced a 75% CRR on non-TSA public deposits, while inflation eased to 20.12% in August 2025 (from 21.88% in July), supported by food and core price moderation, FX stability, and higher oil output.

Cardoso confirmed 14 banks have fully met recapitalization requirements and highlighted stronger buffers, with external reserves rising to $43.05 billion and the current account surplus improving to $5.28 billion in Q2.

He mentioned that Payment Systems Vision 2028 is aimed at driving financial inclusion, digitization, and AI adoption: “With PSV 2028, we’re building a payment system fit for purpose, lifting people out of poverty, driving inclusion, and embracing innovation.”

Marking two years in office, the Governor reaffirmed: “Nigerians can trust the CBN. Reforms have stabilized the economy, restored investor confidence, and built a platform for sustainable growth. Confidence in the naira is returning, FX and reserves stability are here to stay.”

The MPC also expressed satisfaction with the prevailing macroeconomic stability, which it said evidenced by the improvements in several indicators. These include the sustained disinflation, improved output growth, stable exchange rate and robust external reserves.

It particularly noted the increased momentum of disinflation in August 2025, being the highest in the past five months. This deceleration, underpinned by monetary policy tightening, exchange rate stability, increased capital inflows, and surplus current account balance, have helped to broadly anchor inflation expectations.

Other factors that contributed to the deceleration include the continued moderation in the price of Premium Motor Spirit (PMS) and the notable increase in crude oil production. In the view of the Committee, the stability in the macroeconomic environment offered some headroom for monetary policy to support economic recovery.

Notwithstanding the consistent deceleration in inflation, the Committee observed the persistent build-up of excess liquidity in the banking system, resulting largely from fiscal releases emerging from improved revenues. Being mindful of the need to preserve the prevailing macroeconomic stability, the MPC noted the risk posed by excess liquidity in the banking system.

Members noted that effective functioning of the interbank market remains critical to enhanced transmission of monetary policy. This, therefore, informed the decision to adjust the width of the standing facilities corridor to boost interbank market transactions and enhance the stability of the market.

The Committee acknowledged the continued stability of the foreign exchange market and its critical importance in achieving rapid disinflation, and therefore called on the Bank to continue the implementation of policies that would further boost capital inflows and deepen foreign exchange liquidity.

On the financial sector, the MPC noted the continued resilience of the banking system, with most of the financial soundness indicators remaining within their respective prudential benchmarks. Members also acknowledged the significant progress in the ongoing bank

They therefore urged the Bank to continue the implementation of policies and initiatives that would ensure the successful completion of the ongoing recapitalization exercise.

The Committee further noted the successful termination of forbearance measures and waivers on single obligors, which has helped to promote transparency, risk management and long-term financial stability in the banking system. The MPC reassured the public that the impact of the removal of forbearance is transitory and does not pose any threat to the soundness and stability of the banking system.

With regard to price and other domestic developments, the Committee observed that headline inflation (year-on-year) moderated further to 20.12 per cent in August 2025, from 21.88 per cent in July, driven by the decline in both food and core inflation. On a month-on-month basis, headline Inflation also decreased to 0.74 per cent in August 2025 from 1.99 per cent in the preceding month. Similarly, core inflation (year-on-year) eased to 20.33 per cent in August 2025, from 21.33 per cent in July, due to the slowdown in the cost of services, housing and utilities, as well as transport and logistics. Food inflation (year-on-year) also moderated to 21.87 per cent in August 2025, from 22.74 per cent in July, attributed to the decline in the prices of staples, especially rice, guinea corn, maize and millet.

On output, the Committee stated: “recently released GDP for the second quarter of 2025 showed the sustained resilience of the Nigerian economy with a real growth rate of 4.23 per cent (year-on-year) compared to 3.13 percent in the first quarter of 2025.”

It particularly noted the significant improvement in the performance of the oil sector which grew by 20.46 per cent compared to 1.87 per cent in the preceding quarter, a positive development that is expected to further bolster foreign exchange reserves and sustain stability in the foreign exchange market.

In this regard, the Committee commended the efforts of the Federal Government and called for continued vigilance to strengthen the momentum of security across the country in order to increase oil output and food production.

It expressed that CBN Gross external reserves remained robust at US$43.05 billion on September 11, 2025, compared with US$40.51 billion at end-July 2025 with an import cover of 8.28 months. Similarly, the Q2 2025 current account balance recorded a significant surplus of US$5.28 billion compared with US$2.85 billion in Q1 2025.

Dangote Refinery: Staff Cuts Needed to Tackle Safety, Sabotage Threats

According to the Committee, available projections indicate that global output recovery is expected to improve on the back of favourable trade negotiations and monetary policy easing, particularly in the advanced economies. However, it noted, persistent geopolitical tensions and lingering trade uncertainties could disrupt global supply chains and dampen the outlook.

Global inflation, it stated, is projected to sustain its deceleration, albeit, at a slower pace, due to the impact of trade tariffs and other structural challenges. This trajectory has necessitated a cautious and data-dependent approach to monetary policy easing by central banks, especially in emerging markets and developing economies, the Committee added.

On outlook, it said staff projections suggest a sustained disinflation over the coming months, driven by the lagged effects of previous rate hikes, continued stability in the foreign exchange market, and decline in the price of PMS. Furthermore, it projected, the onset of the harvest season is expected to increase local food supply, moderate food prices and contribute to the overall decline in inflation.

It assured that in its commitment to achieving the core mandate of price stability, the Committee will remain proactive through a data-driven policy response.

For ordinary Nigerians, all these could eventually lead to lower interest rates on loans and a more stable economic environment, potentially boosting job creation and improving purchasing power, though the transition is not immediate and inflation, though easing, remains a factor.